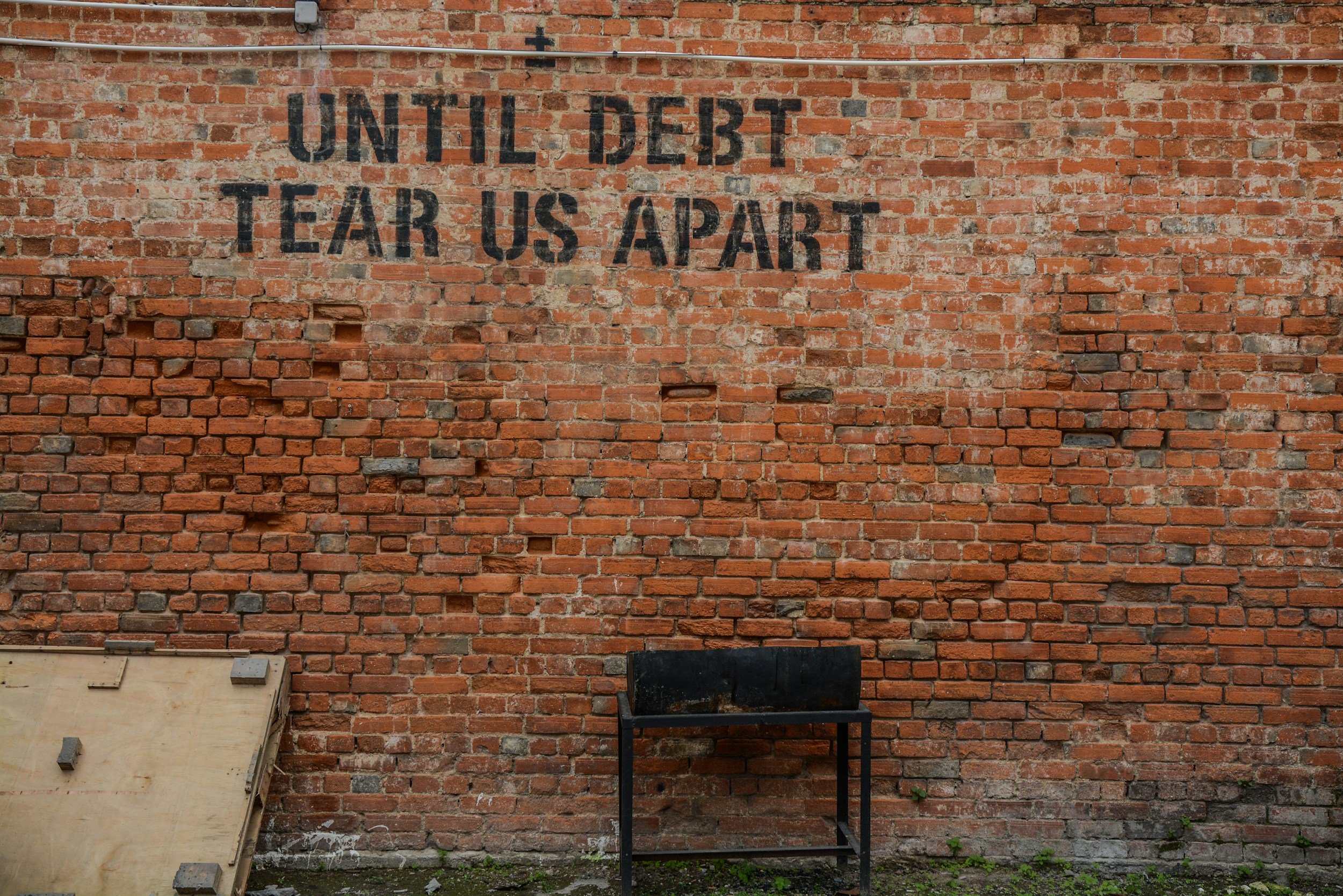

Breaking the Debt Cycle: A Path to Financial Freedom

Debt can feel like a never-ending cycle, consuming your paycheck before you even see it. High interest rates, minimum payments, and unexpected expenses can make it seem impossible to break free. However, the right mindset, strategy, and discipline can escape the debt cycle. Here’s how you can take control of your finances and pave the way toward financial freedom.

Understanding the Debt Cycle

The debt cycle begins when borrowing becomes a necessity rather than a choice. Whether credit cards, personal loans, or payday advances, many people turn to debt to cover everyday expenses, medical bills, or emergencies. Over time, as interest accumulates and payments increase, borrowers pay more toward interest than the actual balance. This creates a cycle of dependency where new debt is taken on to cover the old debt.

Step 1: Assess Your Debt

The first step to breaking the cycle is understanding exactly how much you owe. Make a list of all your debts, including:

Outstanding balances

Interest rates

Minimum monthly payments

Due dates

This comprehensive view will help you prioritize which debts to tackle first and create a realistic repayment plan.

Step 2: Stop Accumulating New Debt

To break free, you must stop adding to your debt. Here’s how:

Freeze unnecessary spending. Identify areas where you can cut back.

Avoid credit card reliance. Stick to cash or a debit card.

Build an emergency fund. Even a small savings cushion can prevent the need for future borrowing.

Step 3: Choose a Debt Repayment Strategy

There are two popular methods for paying off debt:

Debt Snowball Method: Focus on paying off the smallest debt first while making minimum payments on others. Once the smallest debt is cleared, move to the next smallest. This method builds momentum and motivation.

Debt Avalanche Method: Focus on paying off the highest-interest debt first while making minimum payments on the rest. This method minimizes interest paid over time.

You can choose the approach that best fits your financial situation and motivates you to stay committed.

Step 4: Negotiate and Consolidate Debt

Many lenders are willing to work with borrowers who are proactive about repayment. Consider:

Negotiating a lower interest rate. Call your creditors and ask for better terms.

Debt consolidation loans. These combine multiple debts into one loan with a lower interest rate.

Balance transfer credit cards. If you qualify, a 0% introductory APR card can help reduce interest payments.

Step 5: Increase Your Income

Reducing expenses is essential, but increasing income can accelerate your debt payoff. Consider:

Freelancing or side hustles to bring in extra money.

Selling unused items for quick cash.

Asking for a raise or pursuing a higher-paying job.

Applying additional income directly toward debt will help you break free faster.

Step 6: Build Healthy Financial Habits

Once debt is under control, avoiding falling back into old habits is crucial. Establish financial discipline by:

Creating and sticking to a budget. Allocate money wisely each month.

Continuing to save. Even after paying off debt, an emergency fund is essential.

Using credit responsibly. If you use credit cards, pay them off in full each month.

Final Thoughts

Breaking the debt cycle isn’t easy, but it’s entirely possible. You can regain financial control by taking a strategic approach, cutting back on unnecessary expenses, and staying disciplined. The journey to financial freedom starts with one step—make today the day you commit to a debt-free future.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Please consult a financial advisor or credit union representative to determine the best course of action for your financial situation.