Get paid to stay in your home

There are lots of misconceptions about reverse mortgages, but they can be really helpful for many people. With over 20 years of experience in reverse mortgage loans, let us answer all your questions so you can decide if a reverse mortgage would be an asset to enhance your retirement.

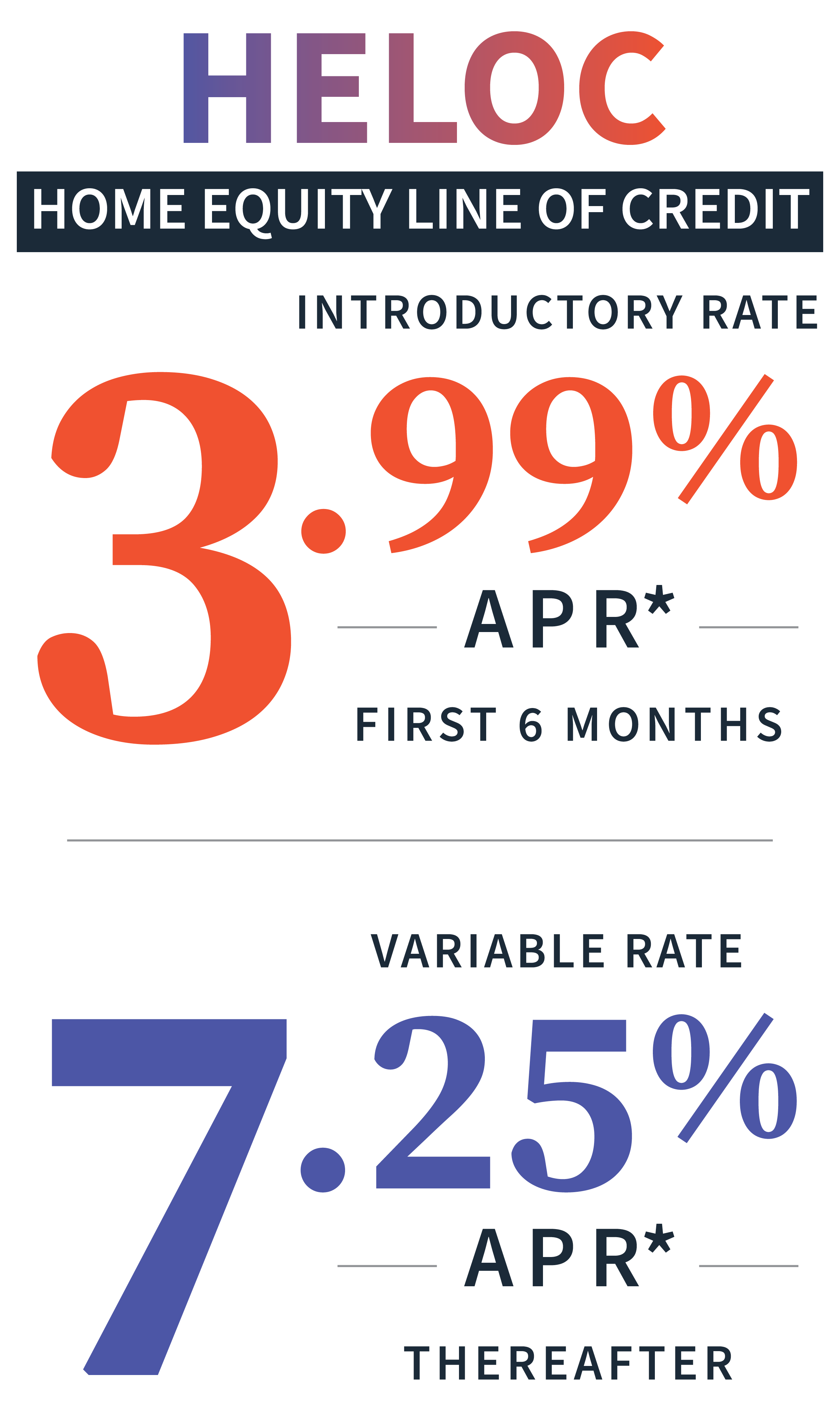

Reverse mortgages are unique loan products designed for homeowners who are at least 62 years old and have significant equity in their homes. Unlike traditional mortgages, reverse mortgages allow homeowners to convert a portion of their home equity into loan proceeds, which can be received as a lump sum, fixed monthly payments, a line of credit, or a combination of these options. What sets reverse mortgages apart is that borrowers are not required to make monthly mortgage payments.

Instead, the loan is repaid when the homeowner sells the home, moves out of the property, or passes away. Reverse mortgages are often sought by seniors looking to supplement their retirement income, cover healthcare expenses, or simply improve their financial security. They offer flexibility and can provide a reliable source of funds for those who wish to age in place and enjoy the comfort of their own homes. It's important to note that reverse mortgages come with certain eligibility requirements, loan limits, and obligations, so it's crucial to carefully review the terms and consult with a financial advisor before considering this option.

To find out if a reverse mortgage is right for you, give Tom a call at 801-597-2700 or fill out the form below for a call back.